Before UPI, the mobile payment app market comprised two types – eWallet-based payment app or mobile banking-based payment app. There were also some hybrids of the two like Pockets released by ICICI. With the advent of UPI, the line between the two types smudged a little bit and everyone was adding UPI support to their apps. A simple no-nonsense app, which was done right and excelled in showcasing the benefits of UPI. It was surprising since it was launched by the Government of India. Currently, giving BHIM some major competition is another popular app – PhonePe. Both have more than 10 million downloads on Google Play Store. So let’s see how does Tez compare with these two apps.

Features & Ease of Use

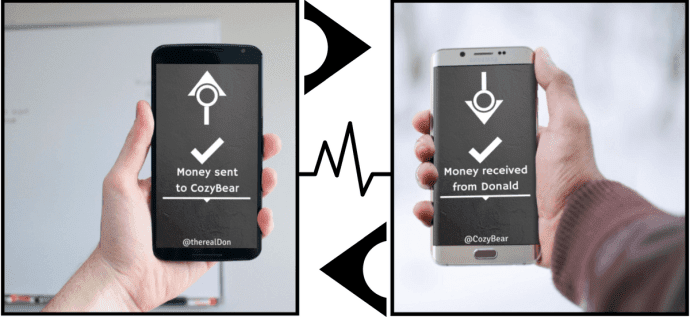

We will start with the features offered by each of the apps. And without even a glance at all the apps, I (and you as well) can tell that PhonePe is the clear leader here. If we were to rank them in an ascending order, it would be BHIM . Below, I have summarized the features. Tez does have a Rewards system but there is nothing there currently. The Offers segment does have a promotion going on where you can earn Rs. 51 if you invite your friends to join Tez and transfer him or her any amount of money. BHIM, as you can see, is only for pure UPI transactions. One innovative feature of Tez is the Cash Mode, which allows you to send money to another nearby Tez user. Tez also uses a process involving audio frequencies to identify a nearby device, which is called Audio QR by Google. In terms of ease of use, BHIM is the clear winner. The UI is uncluttered and setting the app up and doing a transaction is a cakewalk. The other two apps also fare well but with the many features they have to offer, things get a little crowded. PhonePe’s home screen is filled with more than 16 options – from sending money to paying bills. Similarly, Tez’s screen is filled with a gigantic button for the Cash Mode with the additional options accessible with a swipe up. Truth to be told, I am nit-picking at this point and you will easily get used to any of the three apps in no time.

Security & Support

Google is emphasizing the security part in a big way. A suite of technologies collectively known as Tez Shield protect your information from hacking or phishing. But Google does not explain in detail what these security features are. Apart from Tez Shield, the transactions are protected by UPI PIN, which is part of the UPI standard and your phone’s PIN or fingerprint. BHIM also has a PIN lock to access the app plus the UPI for authenticating every transaction. I hope PhonePe adds an access lock in a future update. Because if someone loses his or her bag containing wallet and mobile phone both, the UPI app can be used to transfer money as UPI PIN can be reset using the last six digits of your debit card and OTP. In terms of bank support, all three apps support all the banks listed in UPI. PhonePe also has support for paying various bills for electricity, gas, insurance and also recharges for mobile phone and DTH. BHIM and Tez support merchant payments but they also rely on the merchant to have the app. So, if the merchant does not use BHIM or Tez you are out of luck. Google is again pushing for this one with the Business Channel feature.

What We Think

It’s pretty easy to conclude this comparison. Tez has to do a lot to catch up with its competitors. And it also depends on people and merchants adopting it. Google has some serious marketing to do. Between the rest two, your usage decides which one will be more beneficial. If you use UPI for only money transactions between bank accounts, then BHIM is better suited for you. But if you want an all-in-one app that does an e-wallet and mobile banking, PhonePe is the one to choose. This is all in ou opinion. Do share how you find the apps in the comments section below. The above article may contain affiliate links which help support Guiding Tech. However, it does not affect our editorial integrity. The content remains unbiased and authentic.